Passive Income Ideas for Students to Earn Money by Studying

Are you a student juggling a tight budget and a packed academic schedule? Earning money without compromising your studies is possible through passive income. In this blog post, we’ll share the top passive income ideas for students, explain why passive income is especially advantageous during college, and offer actionable tips to help you start your journey to financial independence.

What Is Passive Income?

Passive income is money earned via minimum continuous work. Unlike active income, which necessitates ongoing effort (such as a part-time job or freelancing), passive income allows you to earn money while not actively working. This might include profits from investments, royalties, or secondary enterprises operating independently after the establishment.For students, passive income is a game changer. It provides a means to relieve financial stress without continually exchanging hours for bucks. However, it's crucial to note that passive income requires less effort over time but typically requires some initial labor or investment.

Why Passive Income is a Smart Choice for Students?

For students, passive income is a great option to supplement their income while maintaining their academic concentration. It comes with several perks.1. Flexible Earning Opportunities

Passive income allows college students to generate money without the limits of a set employment schedule. Unlike typical occupations requiring set hours, passive income sources operate in the background, freeing your time for academic obligations and extracurricular activities. This flexibility enables students to concentrate on their education and personal development without the extra strain of juggling a job.

2. Ease Financial Stress

The financial demands of college, such as tuition, books, and living expenses, can be burdensome. Passive income can alleviate financial constraints by offering a consistent supply of additional dollars. This extra income can minimize or eliminate the need for student loans or part-time jobs, allowing students to focus on their studies rather than their finances.

3. Focus on Education

With a passive income stream, students may concentrate on their studies without being distracted by financial concerns. This consistency allows students to completely engage in academics, take advantage of educational opportunities, and do better academically. Financial security may contribute to a more enjoyable and successful college experience.

4. Achieve Financial Freedom Early

Creating passive income while in college is a step towards financial freedom. Students may begin to accumulate money and gain financial literacy by making sensible investments or starting their own businesses. This early exposure to handling cash independently can provide children a major advantage in life, preparing them for financial success after graduation.

5. Develop Valuable Skills for Future Success

Pursuing passive income alternatives frequently entails acquiring new and valuable skills like investment, digital marketing, and entrepreneurship. These abilities are not only useful for producing revenue in college, but they are also highly transferable to future employment. Students can improve their employability and open doors to various professional prospects after graduation by establishing a varied skill set through passive income pursuits.

Best 20 Passive Income Ideas for Students

There are several options for students to make passive money, each with advantages and disadvantages. Below are 20 of the greatest passive income ideas for students that fit into a student's lifestyle.1. Create a YouTube Channel or Niche Blog

You may eventually build a devoted following on your blog or YouTube channel and earn revenue by employing various techniques, such as Google AdSense, affiliate marketing, and sponsored content. These revenue sources give your platform a steady income stream as it grows.

- Skills Required: Basic to advanced content development, SEO, and video editing.

- Education Required: None, however understanding SEO and content production is beneficial.

- Investment: Low to moderate, including domain registration, hosting, and equipment (for YouTube). Approximately $100 to $500.

- Scope: Global, depending on your specialization and marketing strategies.

- Time required: Significant initial work for content production and audience growth; low ongoing effort once established.

- Earnings: Ad income, affiliate marketing, and sponsored articles have the potential to generate $100-$5,000 or more each month.

2. Invest in Dividend-Paying Stocks

For newbies, it's critical to look at firms with a long history of dividend payments and excellent financial stability. Furthermore, diversifying your assets across industries might help reduce risk. While the initial returns may appear little, the force of compounding may result in enormous wealth creation, making this an excellent long-term passive income approach.

- Required Skills: Basic to Intermediate Investment Knowledge, Financial Analysis.

- Education Required: None; basic financial education is useful.

- Investment: Low to moderate; the minimum investment varies, usually starting at $500-$1,000.

- Scope: Global, having access to many industries and enterprises.

- Time Required: minimal continuing time, major initial research, and frequent monitoring.

- Earnings: A typical 2-5% yearly dividend yield on your investment, plus potential capital gains.

3. Create an Online Course

This provides cash rewards and allows you to construct your brand and position yourself as an authority in your profession. Furthermore, establishing a course helps you improve your communication and teaching abilities, which are useful in both academic and professional settings.

- Required Skills: Subject matter knowledge, course design, and marketing.

- Education Required: Expertise in the subject topic; educational expertise in the field might be advantageous.

- Investment: Low to moderate; expenditures for course development tools and promotion. Approximately $100 to $1,000

- Scope: Global, with access to a broad audience via Internet outlets.

- Time Needed: Significant initial work for course building; minor continuing upkeep.

- Earnings: Range from $200 to $10,000 or more each month, depending on course popularity and cost.

4. Sell Stock Photography

Selling stock images is a great method for students who enjoy photography to turn their pastime into a passive cash stream. Platforms such as Shutterstock, Adobe Stock, and iStock allow you to post photographs that can subsequently be purchased by people or businesses for various purposes, including advertising, web design, and publishing.

Each sale generates a royalty, and popular photographs can be sold several times, resulting in constant income. To increase your revenue, focus on high-demand topics such as business, technology, or lifestyle, and keep uploading new material. Over time, a big collection of high-quality photos may provide a consistent stream of passive income with little effort.

- Required Skills: Photography, image editing.

- Education: No education is necessary, nevertheless, photography classes might improve abilities.

- Investment: Low investment, expenses for camera equipment and editing software. Approximately $200 to $1,000

- Scope: Global, with potential for significant exposure through stock photography outlets.

- Time Required: Moderate; time required for photographing and uploading

- Earnings: Range from $50 to $2,000 a month, depending on the volume and popularity of photos.

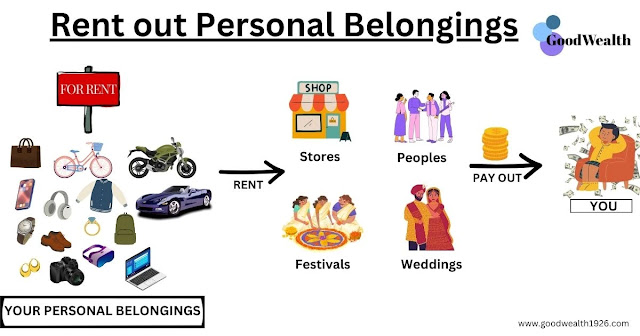

5. Rent out Personal Belongings

Renting out personal possessions is an innovative method for students to earn money from goods they already own but seldom use. Whether it's your vehicle, bicycle, photography equipment, or textbooks, sites like Turo (for automobiles) and Fat Llama (for other products) connect you with others eager to rent them. This enables you to make money from your belongings without having to sell them.For example, if you have a car that you only use on weekends, renting it out during the week might make you money. Similarly, renting textbooks you no longer need might help cover the expense of purchasing new ones. This strategy involves little time and effort and can give you a consistent source of passive money while you work on your academics.

- Required Skills: Basic management and customer service.

- Education Needed: None necessary.

- Investment: Low, minimum initial investment if products are already owned.

- Scope: Local, based on platform and demand.

- Time Required: Minimal, time is necessary to list and manage rentals.

- Earnings: Range from $50 to $1,000 or more a month, depending on the item and rental frequency.

6. Affiliate Marketing

To thrive in affiliate marketing, identify items that are relevant to your audience and develop content that organically includes these products, whether through reviews, lessons, or suggestions. Once your affiliate links have been placed into your content, they will continue to produce revenue as long as the material is relevant and attracts visitors.

- Skills required: Content development, marketing, and SEO.

- Education Required: None; marketing expertise is good.

- Investment: Low; charges for website/domain may apply. Approximately $50 to $200.

- Scope: Global, with the opportunity to reach a large audience via multiple media.

- Time Required: Significant initial work for content production, with low recurring effort

- Earnings: It might range from $100 to $5,000 or more each month, based on traffic and affiliate items.

7. Real Estate Crowdfunding

Real estate crowdfunding is a novel approach for students to invest in property ventures without requiring considerable funds. Real estate platforms like Fundrise and RealtyMogul enable you to combine your funds with other investors to support real estate developments such as residential, commercial, and industrial buildings. In exchange, you receive a percentage of the rental revenue and any increase in the property's value.This investment option is especially tempting to students since it allows you to begin with a small sum of money and diversify your portfolio over numerous houses. While real estate crowdfunding is typically regarded as a long-term investment, the prospect of consistent income and capital gains makes it an appealing alternative for people wishing to accumulate money gradually while completing their education.

- Required Skills: Basic investing knowledge, and understanding of real estate.

- Education Required: None; finance and real estate education is advantageous.

- Investment: Low to moderate; the minimum investment often ranges from $500 to $1,000.

- Scope: National or worldwide, based on the platform.

- Time Required: Minimal continuing time; initial research and investment management are necessary.

- Earnings: Typically 6-12 percent (%) yearly return on investment, combining rental revenue and property appreciation.

8. Create and Sell Digital Products

Creating and selling digital items is a flexible option for students to generate passive money. Digital items, such as eBooks, printables, software, or templates, may be sold several times with no further work. Platforms such as Gumroad, Etsy, and Amazon offer simple access to a worldwide market, allowing you to reach clients who are interested in your items. If you are excellent in graphic design, you may make and sell printed planners or digital artwork.If you're a writer, you may self-publish an eBook on a familiar subject. The key to success with digital products is to offer something valuable to your target audience that can be readily copied and sold numerous times. Over time, your digital items may create a consistent source of cash with little continuing effort.

- Required Skills: Design, Writing, or Programming.

- Education Required: Education is not necessary; nonetheless, abilities in the appropriate sector are vital.

- Investment: Low, expenses for design software or marketing. Approximately $50 to $500.

- Scope: Global, with access to a large audience via internet outlets.

- Time Needed: moderate, the time needed for production and marketing.

- Earnings: It might range from $100 to $5,000 or more each month, depending on product popularity and sales volume.

9. Peer-to-peer Lending

Peer-to-peer lending is a financial strategy in which you lend money to people or small businesses in return for interest payments. LendingClub and Prosper enable these transactions, allowing you to diversify your risk by investing in various loans. Peer-to-peer lending provides students with the option to earn returns that are typically larger than those from traditional savings or bonds.However, it is critical to thoroughly evaluate the risk involved with each loan, as default is always possible. You may decrease risk and provide a consistent stream of interest income by distributing your assets among multiple borrowers and carefully selecting loans with high credit ratings.

Peer-to-peer lending sites such as LendingClub and Prosper enable you to lend money to people or small businesses in exchange for interest payments. Diversifying your loans among several customers allows you to decrease risk while earning a consistent return on investment. This strategy allows you to create passive income with comparatively little capital.

Starting a dropshipping business appeals to students interested in e-commerce but who do not want to deal with inventory management. Dropshipping involves creating an online business and listing things for sale. When a client puts an order, the goods are transported straight from the supplier to the consumer, saving you from having to handle the products yourself. Dropshipping stores may be easily set up and managed using platforms like Shopify and Oberlo.

- Skills Required: It includes basic financial analysis and risk assessment.

- Education: None is necessary; financial education might be advantageous.

- Investment: Low to moderate; the minimum investment ranges from $25 to $100 for each loan.

- Scope: national or worldwide, depending on the platform.

- Time Required: Minimal; loan selection and monitoring

- Earnings: Typically 5–10% yearly return on investment, depending on the risk level of the loans.

10. Start a Dropshipping Business

While there is some initial effort necessary to set up the store, choose the correct items, and market your business, once it is up, a drop shipping business may create cash with little continuing commitment. This approach is especially interesting to students since it allows them to concentrate on their education while also operating a lucrative business.

Dropshipping enables you to sell things online without maintaining inventories. Partnering with suppliers allows you to sell their items on your website and benefit from each sale. With the correct marketing strategy and product selection, drop shipping may be a highly successful passive income source.

- Skills Required: E-commerce management, marketing, and customer service.

- Education: None necessary; understanding of e-commerce is useful.

- Investment: Low to moderate, including shop setup and marketing expenditures. Around $100-$500.

- Scope: Global, with the potential to reach clients throughout the world.

- Time Requirements: Significant upfront work for setup and promotion; low continuing effort

- Earnings: Depending on product selection and promotion, earnings can range from $100 to $5,000+ each month.

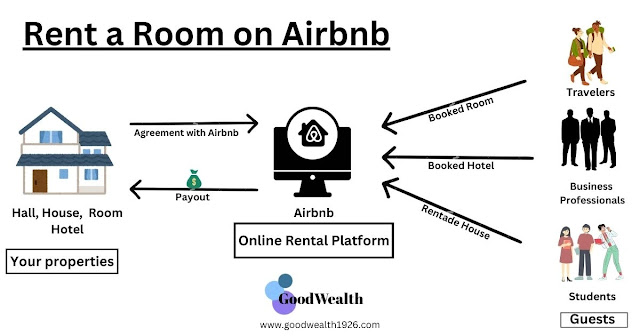

11. Rent a Room on Airbnb

If you have an extra room in your flat or house, renting it out on Airbnb might be a lucrative method to generate passive money. Depending on your region, short-term rentals might be in great demand, particularly in college cities or tourist destinations. You may earn money by selling your room on Airbnb and renting it out to travelers, business professionals, and others.Airbnb allows you to choose your pricing, availability, and house rules, giving you the freedom to host visitors on your terms. This option is especially useful for students who live off-campus and wish to offset their living expenditures. Additionally, hosting on Airbnb may be a wonderful way to meet new people from all over the world while also earning additional money.

- Skills Required: Hospitality and basic property management.

- Education Needed: None necessary.

- Investment: Low to moderate, expenditures for setting up and maintaining the space. Approximately $50 to $500.

- Scope: Local, with the potential to attract worldwide guests.

- Time Required: Moderate, the time necessary for hosting and handling reservations.

- Earnings: It might range from $500 to $3,000 or more each month, depending on location and booking frequency.

12. Print on Demand

Print-on-demand services enable students to sell custom-designed goods such as t-shirts, mugs, and posters without having to invest in inventory. When a consumer purchases a product, the service provider (such as Redbubble, Printful, or Teespring) prints and ships it straight to them. This means you can concentrate on designing unique designs rather than worrying about manufacturing or delivery problems.To thrive with print-on-demand, designs should appeal to a certain niche or target demographic. Once your drawings are posted to the marketplace, they may be sold several times, offering a consistent source of passive revenue. This business strategy requires little initial investment and may be handled alongside your study.

- Skills Required: Graphic design, marketing.

- Education: None necessary; design skills can be upgraded through classes.

- Investment: little, largely time and design tools. Approximately $10–$100

- Scope: Global, with the opportunity to reach a large client base.

- Time Required: Moderate; time required for designing and submitting designs, with low continuing work.

- Earnings: Range from $100 to $2,000 a month, depending on design popularity and sales volume.

13. High-Performance Savings Plans

A straightforward but efficient method for students to generate passive income with almost no risk is through a high-yield savings account. With these accounts, you may increase your money slowly over time since they provide greater interest rates than standard savings accounts. An accessible and secure alternative for students who might not have the opportunity to pursue more intricate passive income sources is a high-yield savings account.The secret is to compare accounts that have no monthly fees and attractive interest rates. A high-yield savings account is a sensible option for students who want to increase their funds without putting in extra work, even though the returns might not be as high as those of other investments due to its security and liquidity.

- Skills Required: Basic financial management.

- Education: None necessary.

- Investment: Low investment, an initial deposit is required. Approximately $100 to $1,000

- Scope: National, based on the bank

- Time Required: Minimal; time needed for initial research and setup

- Earnings: Typically 5-10% yearly interest on savings, depending on the account and market circumstances.

14. Create a Mobile App

Creating a mobile app is a tough but potentially lucrative method to produce passive income. If you know how to program, you may design an app that solves a problem, entertains, or provides a beneficial service. Once built, your app may be released through app stores such as Google Play or the Apple App Store, where consumers can either download it for free or pay.You may also monetize your app by offering in-app purchases, subscriptions, or advertising. While app creation involves a big initial investment, a good app may earn significant revenue over time with minimum upkeep. This option is especially intriguing to students studying computer science or related subjects since it allows them to use their talents in a real-world setting while earning money.

- Skills Required: Programming, app design, marketing.

- Education Required: Programming skills; computer science education is advantageous.

- Investment: Moderate to high; expenses for development tools and marketing. Approximately $1,000–$10,000

- Scope: Global, with the potential for reaching a big user base.

- Time Required: Significant development time; low continuing work for upkeep.

- Earnings: Depending on app popularity and monetization tactics, earnings might range from $100 to $10,000 or more each month.

15. License Your Music

For students who are musicians or composers, licensing your music might be a profitable option to generate passive cash. Uploading your songs to websites such as Pond5, AudioJungle, or Epidemic Sound allows you to license your music for usage in advertisements, films, video games, and other media. You get royalties every time your music is utilized, resulting in a constant cash stream.This option is especially appealing to students who already like making music as a pastime, as it allows them to monetize their skills with no additional work. The key to success in music licensing is to provide high-quality recordings that are adaptable and can be utilized in many settings. Over time, a well-curated music collection may yield substantial passive income.

- Skills Required: Music writing, recording, and production.

- Education Required: None, music instruction can increase talent.

- Investment: Low to moderate, expenses for recording equipment and software. Approximately $100 to $1,000.

- Scope: Global, with the potential for widespread diffusion.

- Time Required: Moderate, time needed to create and submit music, with recurring income.

- Earnings: Can range from $50 to $2,000 per month, depending on music use and licensing agreements.

16. Create a Podcast for Passive Income

Podcasting is a fast-expanding medium that provides a wonderful opportunity for students to earn passive money. You may establish a dedicated audience who tunes in regularly by generating compelling and niche-specific material. Once your podcast has gained success, you may monetize it with sponsorships, adverts, listener contributions, and premium content offers.Anchor and Patreon make it simple to create, distribute, and monetize your podcast. Building a successful podcast needs regular effort in content development and promotion, but it may potentially offer continual passive revenue as your following grows. Podcasting is especially interesting to students who like storytelling, interviewing, or discussing issues they are passionate about, as it allows them to express themselves while making money.

- Skills Needed: Audio production, content development, and marketing.

- Education Necessary: None is necessary; media or communication education might be beneficial.

- Investment: Low to moderate; expenses for recording and hosting. Approximately $50-$500

- Scope: Global, with the potential to draw a large audience.

- Time Required: Significant initial work for setup and content production, continuing effort for new episodes.

- Earnings: Vary greatly; possibilities for $100-$5,000+ each month from sponsorships, commercials, or listener donations.

17. Write and Publish an eBook

Writing and self-publishing an eBook is an excellent option for students to generate passive money, particularly if they enjoy writing or have knowledge in a certain field. Platforms such as Amazon Kindle Direct Publishing allow you to publish and sell your eBook to a worldwide audience for a modest initial investment. Once published, your eBook can produce royalties over time with minimal work.To maximize revenue, identify a topic with a specific target audience and sell your eBook efficiently. Writing an eBook also helps you establish yourself as an expert in your subject, which may lead to other chances such as speaking engagements, consultancy, or future writing assignments. This strategy benefits pupils not only financially but also professionally.

Writing and releasing an eBook is an excellent method to share your expertise while earning passive cash. With systems such as Amazon Kindle Direct Publishing, you can reach a worldwide audience while earning royalties on each sale. Once released, your eBook can produce revenue for years to come with a little more effort.

- Skills Required: writing, editing, and marketing.

- Education Required: none; competence in the topic is necessary.

- Investment: Low, expenses for editing and promotion. Approximately $50 to $500.

- Scope: Global, with potential for a big audience.

- Time Required: Significant initial time for writing and publishing, with minimum ongoing work.

- Earnings: It might range from $100 to $5,000 or more each month, depending on eBook sales and price.

18. Maximize Earnings with Cashback and Rewards Programs

Cashback and rewards programs give students a simple yet efficient approach to earning passive revenue from regular transactions. You may earn money or points that can be redeemed for cash, gift cards, or travel incentives by using credit cards that give cashback or rewards points, as well as buying through cashback websites like Rakuten.This strategy is especially beneficial for students who already make frequent purchases since it allows them to generate passive revenue with no effort. To maximize rewards, choose the best offers and pay off your credit card amount in full each month to prevent interest costs. Over time, these benefits might accumulate, giving a financial buffer while you concentrate on your education.

- Skills Required: Basic Financial Management.

- Education Needed: None necessary.

- Investment: None, based on regular spending and the usage of reward cards or websites

- Scope: Local or online, based on cashback offers.

- Time Necessary: Minimal, time necessary to manage awards and cashback possibilities.

- Earnings: Variable, possibility for $50-$500+ each year based on purchasing patterns and cashback offers

19. Invest in REITs for Consistent Passive Income

Real Estate Investment Trusts (REITs) provide students with an easy method to invest in real estate without acquiring or managing the property themselves. REITs are businesses that own, operate, or finance income-generating real estate and provide dividends to investors based on the profits earned by their assets. Investing in REITs enables students to generate passive income with relatively little cash.REITs are listed on stock exchanges, making them easier to purchase and sell, and they frequently pay greater dividends than ordinary equities. Students who invest in a diverse portfolio of REITs can generate consistent income from a variety of real estate sectors, including residential, commercial, and industrial properties while reducing risk. This technique is perfect for real estate students looking to grow money over time.

- Skills Required: Basic investing knowledge, and understanding of real estate.

- Education: None is necessary; financial education might be advantageous.

- Investment: Low to moderate; the minimum investment often starts at $500-$1000.

- Scope: National or worldwide, according to the REITs selected.

- Time Required: little continuing time, initial investigation, and occasional monitoring.

- Earnings: Typically 4–8% yearly dividend yield, with potential capital gains.

20. Create and Sell Software for Long-Term Earnings

Creating and selling software may be a lucrative method for students with programming skills to generate passive money. Software, whether it's a productivity tool, game, or website plugin, may be sold online via platforms such as the Apple App Store, Google Play, or your website. Once designed and published, the software may generate money for years with no additional work. The key to success in software development is to create a product that solves a problem or addresses a specific market demand.Furthermore, providing regular updates or new features will help keep your program current and users interested. This option is especially enticing to individuals studying computer technology or related subjects since it allows them to use their abilities and ingenuity to earn long-term financial benefits.

- Skills Required: Programming, software design, and marketing.

- Education Required: Programming skills and computer science education are advantageous.

- Investment: Moderate to high, including development tools, marketing, and distribution. Approximately $1,000–$10,000

- Scope: Global, with the possibility of broad application.

- Time Required: Significant initial time for development, low ongoing work for upgrades and support.

- Earnings: Depending on software popularity and cost, earnings can range from $100 to $10,000 or more per month.

How to Choose the Right Passive Income Idea

1. Identify Your Skills and Passions

When selecting a passive income source, it is critical to consider your natural strengths and hobbies. For example, if you're a creative writer or like storytelling, blogging or producing an eBook may be a great option. This allows you to use your creative abilities in a way that feels more like a pastime than a job. If you're more analytical or tech-savvy, you can consider designing a mobile app or creating an e-commerce site via drop shipping. Choosing something that fascinates and challenges you makes it simpler to stay motivated over time.

2. Analyze Your Time and Financial Constraints

When contemplating passive income options, it is vital to consider both time and money. Some revenue sources need a significant initial commitment, either in terms of time, money, or both. For example, real estate or developing a product for sale may demand more cash and time at first. If you're limited on time or money, it's best to select methods with low start-up expenses, such as affiliate marketing or generating digital items. These low-cost, low-effort projects allow you to begin generating money without incurring significant financial burdens, making it easy to build up later.

3. Consider Your Risk Tolerance Level

Understanding the risk inherent in each passive income possibility is critical. Some enterprises, such as stock investment or real estate ownership, carry both great profits and considerable risk. These solutions may need a higher tolerance for financial volatility. If you want a more stable income, try lower-risk activities like selling stock photographs, digital courses, or creating a high-yield savings account. Finding the correct mix of risk and reward can help you avoid unneeded stress while working towards your financial objectives.

4. Evaluate Your Goals for Your Long-Term Finances

The decision of which passive income sources to investigate should be mostly based on your long-term financial objectives. Properties, dividend-paying equities, and even long-term cryptocurrency holdings are good possibilities if your goal is to accumulate a substantial amount of money over time. There's a chance for significant gain because these assets often increase in value over time. Instead, think about shorter-term options like renting out a building, starting a membership site, or starting a blog that can bring in money if your main goal is to create a consistent flow of income for urgent necessities like paying bills or covering daily costs.5. Begin Small and Expand Gradually

When exploring passive income options, it's usually a good idea to start modest and controllable. Large endeavors, such as real estate or stock portfolios, can be intimidating initially, especially if you have little expertise. Start with smaller, more manageable initiatives like selling digital items, running a tiny affiliate marketing website, or developing an online course. These sorts of companies have cheap starting expenditures and allow you to learn the ropes without overextending yourself. Once you've gained traction and confidence, you may expand these little initiatives into larger, more profitable streams.

6. Stay Flexible and Adapt to Market Trends

The passive income situation is continuously shifting, particularly as technology advances and market patterns shift. What works now may not work tomorrow. As a result, it's critical to remain versatile and willing to adopt new tactics. For example, the emergence of Bitcoin, blockchain technology, and online course platforms has generated opportunities that were not available a few years ago. Stay informed about new opportunities, and don't be afraid to pivot or increase your passive income sources in response to market shifts. Being adaptable enables you to remain competitive and relevant in a continuously changing financial landscape.

7. Factor in The Learning Curve

Not all passive income ideas are simple to implement; others take specialized skills or a large amount of time to acquire. If you're ready to devote time to schooling, more complex possibilities such as stock market investment, real estate, or even app development may be worth considering. If you want something that does not involve much study, simpler strategies such as affiliate marketing, renting out underutilized space, or selling pre-created digital items may be a better match. Balancing your desire to study with your need for immediate cash can help you make the proper decision.

8. Consider maintenance and ongoing efforts.

Although passive income implies no labor, most streams require some sort of upkeep. For example, real estate investment entails property management or paying someone to do it for you. Similarly, a blog or YouTube channel may require new material to maintain growth, whilst an online store may require customer support and periodic updates. In contrast, more hands-off choices, such as dividend stocks or high-yield savings accounts, need little to no ongoing work after initial setup. Before making a selection, consider how much time and effort you are willing to invest on an ongoing basis.9. Trial and Error

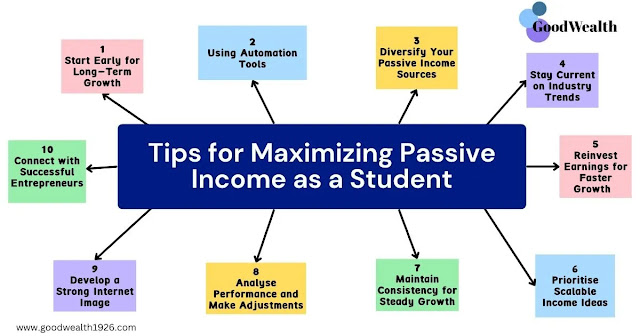

Not all passive income ideas succeed on the first try. Many great entrepreneurs and investors go through a period of trial and error to determine which techniques are most effective for them. This process may include trying several techniques, learning from mistakes, and pivoting as needed. The active work required for trial and error is critical for improving your tactics and maximizing passive revenue.Tips for Maximizing Passive Income as a Student

Once you've determined your passive income idea, use these 10 tested strategies to maximize your earnings potential.

1. Start Early for Long-Term Growth

- The earlier you start, the better your chances of success. Starting today, even with minimal effort, will allow your passive income sources to develop and compound over time. Don't wait time is essential for maximizing passive income.

2. Using Automation Tools

- Use technology to automate your passive income enterprises. Automation technologies for duties like as content scheduling, investment management, and e-commerce platform management may save you time and boost efficiency, allowing you to focus on other objectives.

3. Diversify Your Passive Income Sources

- Spread your income across many streams to decrease risk and maximize profits. Combine numerous passive income strategies, such as blogging, dividend investing, or selling digital items, to ensure you have many streams of income.

4. Stay Current on Industry Trends

- Continue to learn and adapt by staying up to date on the newest passive income trends and breakthroughs. Follow industry blogs, listen to podcasts, and join groups to stay informed about new prospects that might enhance your revenue.

5. Reinvest Earnings for Faster Growth

- Don't simply keep the earnings; reinvest some of your passive revenue back into your firm. Reinvesting in your blog, marketing activities, or investment portfolio will help you develop faster.

6. Prioritise Scalable Income Ideas

- Concentrate on passive revenue concepts that may be scaled without needing significant additional time or effort. Options such as developing digital products, generating royalties, and using automated investing techniques enable growth without requiring hands-on administration.

7. Maintain Consistency for Steady Growth

- Consistency is essential when developing passive revenue sources. Regularly publish material, track your investments, and remain engaged. Long-term success in passive income production requires steady, continuous work.

8. Analyse Performance and Make Adjustments

- Keep track of your money streams and assess their effectiveness. If particular streams aren't functioning well, don't be afraid to change your strategy, optimize your efforts, and remove what isn't working for better results.

9. Develop a Strong Internet Image

- Today's digital world demands a strong online presence, particularly for individuals looking to generate passive income through online enterprises. Use social media to reach a wider audience, establish authority in your industry, and interact with your followers.

10. Connect with Successful Entrepreneurs

- Surround yourself with people who have previously achieved success in passive income. Networking with successful entrepreneurs or joining relevant forums may give you useful insights, partnerships, and chances for development, accelerating your success.

Essential Tools for Building Passive Income as a Student

The correct tools are essential for efficiently developing and sustaining passive income streams. Here are eleven vital tools that can help you succeed:1. Reliable technology

- A quick and steady internet connection, together with a trustworthy computer, is critical for handling passive income operations. To minimize disruptions and keep things operating smoothly, make sure your technology is up to date.

2. Resources For Content Creation

- If you're interested in blogging, YouTube, or selling digital items, you'll need the correct content development tools. Writing software, graphic design applications, video editing tools, and SEO resources (such as Canva, Grammarly, or WordPress) are all required for producing and optimizing high-quality content.

3. Financial management software

- It is critical to manage both your profits and spending. Budgeting tools like Mint and YNAB may help you stay organized, while platforms like Robinhood and M1 Finance make investing easier and more accessible.

4. Tools for Automation

- Efficiency is increased and time is saved via automation. You can automate postings on social media scheduling services like Hootsuite or Buffer, and e-commerce sites like Shopify or Etsy provide capabilities for automating payments, sales, and customer support.

5. Learning Materials

- You must always be studying if you want to grow and enhance your passive income sources. Blogs, webinars, and online classes all offer insightful knowledge and useful skills. You may learn a lot and stay motivated by visiting websites such as Coursera, Udemy, and YouTube.

6. Email Marketing Resources

- Increasing the size of your audience requires building a solid email list. Email campaign automation, engagement tracking, and successful subscriber communication are all made possible by programs like Mailchimp and ConvertKit.

7. Customer Relationship Management

- HubSpot and Salesforce are examples of customer relationship management systems that aid with lead monitoring, customer experience optimization, and streamlining customer interactions. These benefits increase revenue and customer loyalty.

8. Payment Processing Services

- Payment systems such as PayPal, Stripe, or Square are vital for safe online transactions. By providing smooth payment options, these systems make it simple to handle transactions and reward client loyalty.

9. Tools for Market Research

- Success requires an understanding of both industry trends and your target audience. You may follow rivals, examine performance, and spot growth prospects with the use of tools like Ahrefs, SEMrush, and Google Analytics. These tools provide insightful information.

10. Platforms for Project Management

- Maintaining an organization is essential while handling several sources of revenue. Organizational tools such as Trello, Asana, or Notion facilitate effective collaboration and time management by helping you maintain your tasks, objectives, and projects in order.

What Is the Difference Between Passive and Active Income?

Here is an overview of the main distinctions between passive and active income.| No. | Active Income | Passive Income |

|---|---|---|

| 1 | Active income is the money you make by directly participating in work activities. This includes salaries, wages, and freelancing fees, all of which need continuing participation and effort to create revenue. | Passive income is profits that need little to no continuous work beyond the initial setup phase. Individuals can generate money while participating in other hobbies or interests. |

| 2 | Individuals who rely on active income must continuously devote time to their work or freelancing endeavors. The clear association between hours done and cash earned highlights the need for ongoing active participation. | Establishing a passive income stream often necessitates substantial initial effort or commitment. This might include developing items, investing in real estate, or launching a fully automated web business. |

| 3 | Traditional job salaries, freelance work, consultancy fees, and sales commissions are all common sources of active income. These revenue sources need a constant exchange of labor for cash rewards. | Passive income can come from a variety of sources, including rental properties, stock dividends, royalties on creative works, and money from online courses or affiliate marketing. Each source has specific setup and maintenance requirements. |

| 4 | Active income often offers a stable financial condition, with consistent pay cheques or contracted labor providing information about projected revenues. This consistency facilitates budgeting and long-term financial planning. | Once established, passive income may generate consistent earnings for years, providing considerable long-term financial benefits. This revenue stream is especially enticing to those looking to accumulate money over time. |

| 5 | Those that generate active revenue receive quick feedback on their efforts. Diligence can result in promotions, incentives, or increases, driving employees to increase their productivity and total profitability. | Passive income, unlike active income, fluctuates in response to market movements and external economic variables. When adding passive income into one's financial strategy, individuals must be prepared for potential income unpredictability. |

| 6 | The potential for increased active revenue is limited by available working hours. Increasing wages usually necessitates taking on new responsibilities, which can lead to weariness and lower efficiency. | Sources of passive income could not provide feedback as quickly as those that provide active revenue. Success frequently comes with patience and persistence, especially in the early phases of growth. |

| 7 | Active income is normally subject to ordinary income tax rates, and self-employed individuals may have additional tax obligations. Understanding these tax concerns is critical for efficient financial management. | Different forms of passive income may have favorable tax treatment. For example, rental income may allow for depreciation deductions, although capital gains from investments may be taxed at a lower rate. |

| 8 | Individuals who rely primarily on active income are more exposed to job loss or market demand adjustments. Diversifying income sources is critical for guaranteeing financial stability and mitigating risk. | Developing a sustainable passive income stream involves much preparation and study. A well-designed plan may assist in maximizing revenues while minimizing risks, assuring long-term viability and development. |

Benefits of Passive Income for Students

- 1. Early Financial Independence

- 2. More time to focus on studies

- 3. Reduce stress levels.

- 4. Practical financial experience.

- 5. Freedom to pursue interests.

- 6. Opportunity for Long-Term Wealth

The Conclusion

Passive income offers students a fantastic option to make money while concentrating on their education. By researching several passive income ideas for students, you may create a steady source of money that grows over time. Some profitable tactics include affiliate marketing, creating online courses, and investing in dividend-paying companies.Although passive income provides the benefits of flexibility and the opportunity for long-term financial gain, it is important to recognize that it requires an initial investment of time and work to get started. This early labor can result in big financial returns, allowing you to strike a balance between study and revenue-generating. By focussing on passive income options today, you will lay a solid financial foundation for the rest of your college time and beyond. Leverage the possibility of passive income to better your financial situation while remaining focused on your academics!

Passive Income Ideas For Students (FAQs)

Que.1. How can a student earn passive income?

Ans. Students can generate passive money through a variety of successful strategies. Here are some suggestions: Affiliate Marketing, Online Courses, Investing in Dividend Stocks, Rental Income, Print on Demand, Blogging or Vlogging, Create an E-book, Investing in Real Estate Crowdfunding.Que.2. How to multiply your money?

Ans. To multiply your money, examine these crucial tactics.- Invest in Stocks or Mutual Funds: Diversify your investments for long-term returns.

- Real Estate Investment: Buy rental properties or invest in REITs to generate passive income.

- Start a Side Business: Build additional income streams with a side hustle or small business.

- Compound Interest Savings: Leverage high-yield savings accounts, bonds, or interest-earning investments.

- Invest in Personal Growth: Gain new skills or education to increase your earning potential.

- Automate Savings and Investments: Set up automatic transfers to grow your savings consistently.

- Budget and Reduce Expenses: Maximize your savings by cutting unnecessary costs.

Post a Comment